Technology remains private equity's most active sector, accounting for 20% of exits between January 2023 and June 2025, according to Privitas research. We analyzed 73 recent large cap technology exits across over 2,000 datapoints to understand what distinguishes top-performing portfolio companies.

The data reveals a clear hierarchy: M&A-focused strategies achieved 72.7 average PortCo IQ scores (out of 100) followed by 55.9 for Digital Transformation strategies. This gap reflects how in-demand successful platform consolidations are in today’s tech market.

However, 2025 presents a stark pause on three-year trends. The average PortCo IQ score for technology exits collapsed from 55.1 in 2024 to 37.0 in 2025, with zero companies achieving 90th+ percentile performance.

In this 2,000+ word report, you’ll learn about the top-performing recent exits in the technology sector, the decisions that were made that impacted exit outcomes, and the value creation playbooks of different sponsors. You can also request a Deep Dive to benchmark your own portfolio companies against our Index to optimize performance and predict exit outcomes.

Key Findings

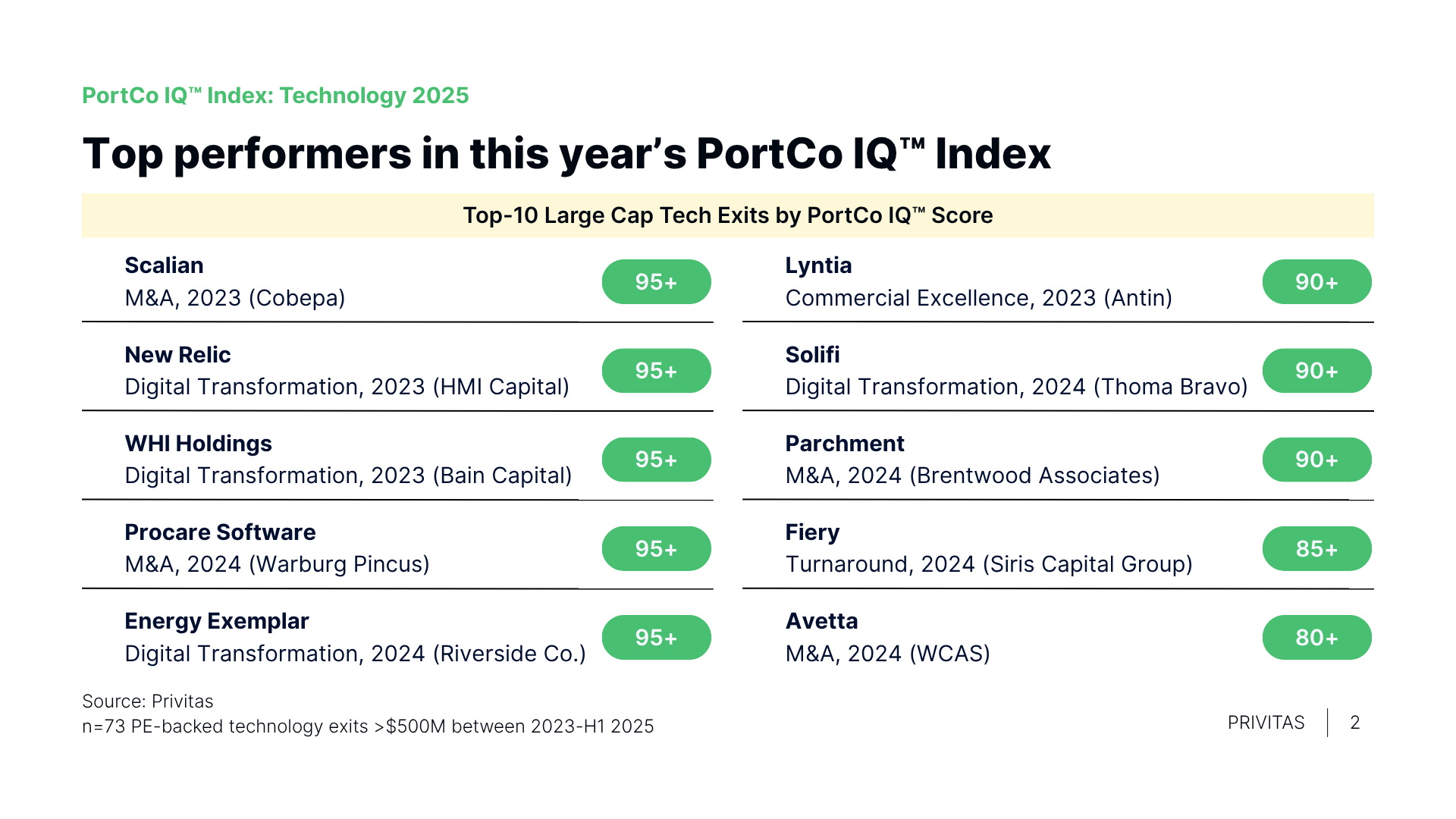

- Two strategies dominate elite performance. 87.5% of technology exits achieving 90th+ percentile scores pursued either Digital Transformation (50%) or M&A (37.5%) strategies. Commercial Excellence contributed only 12.5%, revealing weak commercial execution across portfolio companies.

- Superior productivity defines winners. Top-performing exits achieved $2.2 million average revenue per employee and 400% revenue growth over holding periods. This operational leverage separates premium assets from the rest.

- Financial buyers rule the exit landscape. Eight of the top-10 exits went sponsor-to-sponsor versus 68% overall. Strategic acquirers remain selective with PE-backed tech companies.

- Extended ownership is required. Top performers averaged 5.4-year hold periods with 100% exiting between 4-8 years, versus 4.9 years overall. Sophisticated value creation demands time beyond traditional 3-5 year cycles.

- 2025 performance collapsed. Zero companies achieved 90th+ percentile performance in 2025 versus 10.5% in 2024. Top-tier assets either aren't hitting the market or sponsors won't compromise on valuations.