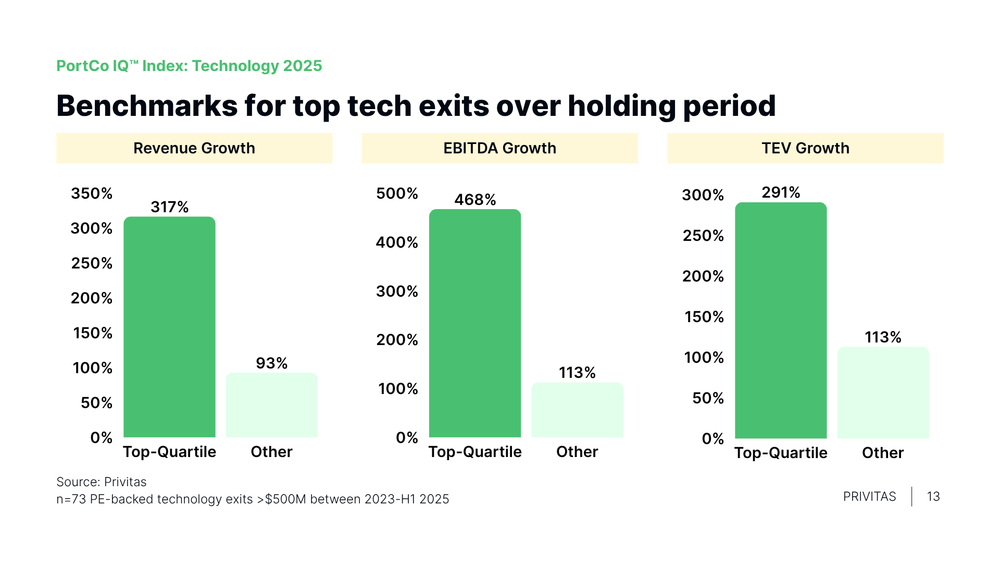

Looking at performance data from the PortCo IQ Index: Technology 2025, top-quartile technology exits significantly outperform their peers across all key metrics over the holding period, with revenue growth of 317% versus 93% for other exits, EBITDA growth of 468% versus 113%, and total enterprise value growth of 291% versus 113%. Privitas identified five best practices that differentiate top-performing PE-backed tech companies from the rest.

The foundation of superior performance in PE-backed tech companies begins with their sponsors. Sector specialists tend to deliver more consistent performance across their tech portfolios than generalist firms. For example, Thoma Bravo and TA Associates each had multiple portfolio companies rank in the top 65th percentile of our PortCo IQ Index, which measured technology exits between January 2023 and June 2025. While more generalist firms might have one portfolio company that ranked in the top quartile of our Index, they were also more likely to have an asset in the bottom quartile as well, suggesting inconsistent performance compared to sector-specialist sponsors.

Another common theme in this year's PortCo IQ Index for technology companies was the prevalence of M&A as a value creation strategy among top performers. Approximately 40% of large-cap tech exits over the past two-and-a-half years pursued M&A as their primary value creation strategy, and their average PortCo IQ score was 73.7 (out of 100). This reinforces the earlier point about why sector-specialist sponsors are outperforming in tech, as their deep knowledge of the landscape lends itself to pursuing platform consolidations.

We also found that nearly every sponsor of a top-quartile portfolio company in this year's Index had a team of full-time operating partners on staff. In many cases, these operating partners took on active leadership roles, driving faster and more comprehensive transformation through hands-on involvement rather than passive oversight. These operators champion technology modernization initiatives that extend beyond simple cost reduction to enable entirely new business models through cloud migration, API development, and automation, creating sustainable competitive advantages that compound over time.

Finally, top performers structure their portfolio companies for multiple exit paths by building businesses that remain attractive to both strategic and financial buyers through careful operational positioning, optimizing exit execution regardless of prevailing market conditions. While sponsor-to-sponsor exits still account for the majority of PE tech exit outcomes (62% between 2023-2025), strategic acquisitions accounted for 30% of outcomes, which is almost 2x the share we see in other sectors.

If you're interested in benchmarking one of your portfolio companies against our PortCo IQ Index, which measures portfolio company performance across four dimensions (financials, operations, market positioning, and talent), please reach out to us at contact@privitas.com.