Privitas analysis of large cap exits (>$500M enterprise value) in H1 2025 reveals three critical market dynamics reshaping exit strategies.

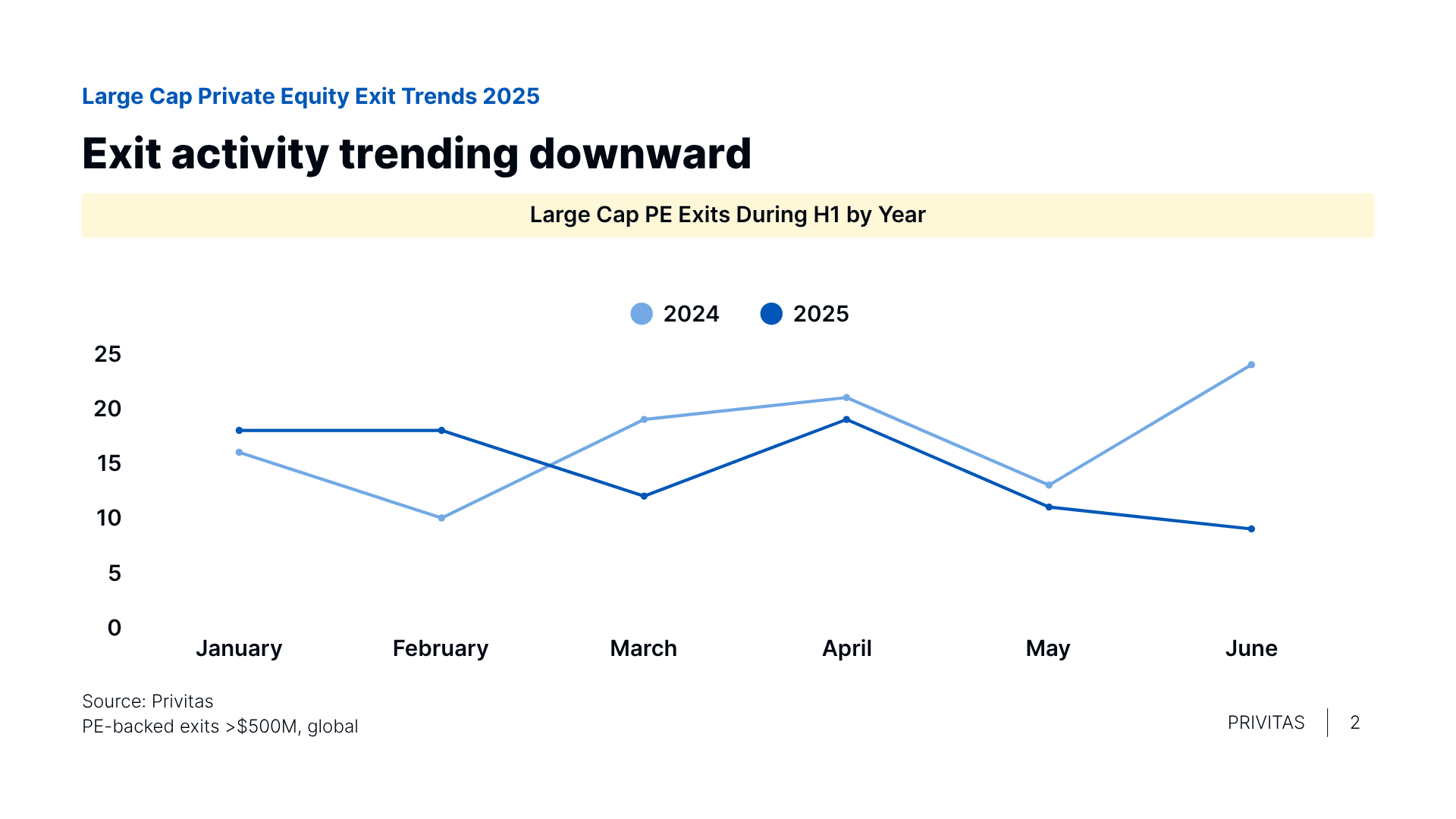

First, we're seeing a noticeable slowdown in private equity exits larger than $500 million, with exit activity down month-over-month for the previous three months. Our analysis of 87 large cap exits in H1 2025 reveals this 16% year-over-year decline masks critical shifts in buyer preferences and value creation strategies that create opportunities for sophisticated sponsors, which we will outline in this research note.

Second, we’re seeing an increased number of exits that utilize Operational Efficiency as their primary value creation focus during the hold period (40% of exits in H1 2025, up from 17% the year prior). EBITDA margins are also up 101 bps to 17.2% for recent exits, showing how operational improvements are having an impact on portfolio company profitability. However, Commercial Excellence strategies are garnering 32% higher premiums in EBITDA multiples, signaling buyer demand for transformative assets at a time when the average annual revenue growth rate of private companies has been declining over previous years.

Third, the rotation into energy stocks in public markets has carried over into private markets with the sector increasing its share of PE-backed exits from 2% to 17% this year. The high premium that we are seeing for companies that focus on ESG / Sustainability in their value creation plans is likely a result of this sector rotation, and not the underlying corporate strategy.